FREEDOMIZATIONTM

“Alternative perspectives on private assets investing”

About Us

The Problems

The sub-sectors of private assets have idiosyncrasies that when well understood can add to the robustness, resiliency, and completeness of a portfolio.

The large number of private assets investment managers/vehicles makes the terrain challenging to navigate without accurate information and astute guidance.

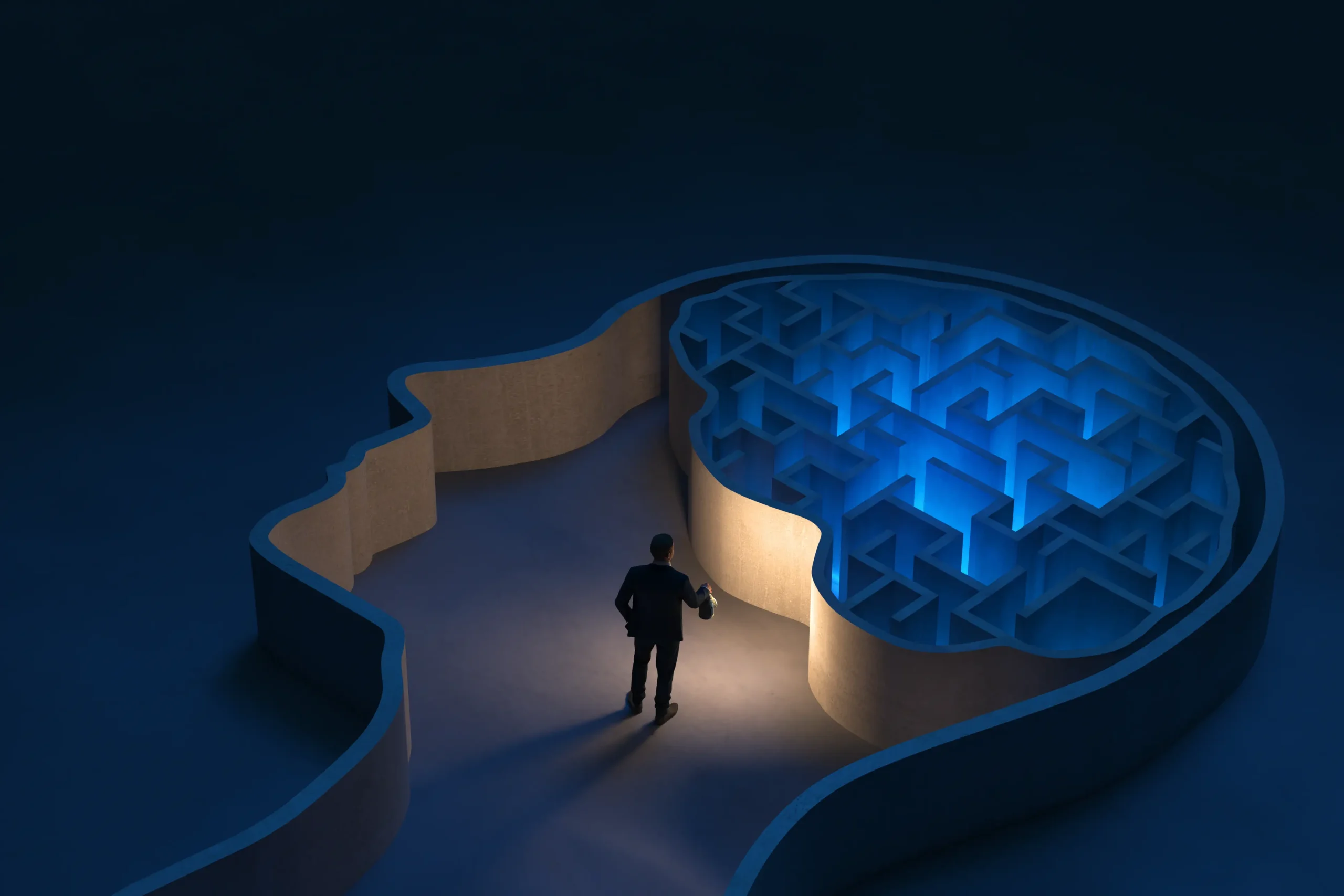

Manager due diligence tends to be quantitative, qualitative, iterative, abstract, and conceptual. Most lack the rigor to get and relay the full story of an investment manager’s essence and strategy.

On the surface most investment managers’ value-add skillsets seem similar. A keen eye for tangible differentiation steered by extensive asset class experience can reveal, dispute, or confirm true uniqueness

There is a considerable amount of confusion on how to construct a high-quality portfolio that takes returns, correlations, liquidity profiles and market resilience into consideration.

The private assets sector is constantly evolving with new sub-sectors regularly emerging – this causes a high degree of misinformation and sometimes disinformation around nascent sub-sectors.

Despite the astronomical growth of the private assets industry in the past decade, there still exists a knowledge gap regarding the characteristics, opportunities, advantages, scope of solutions, structures, etc. in the asset class.

Freedomization’s Solution

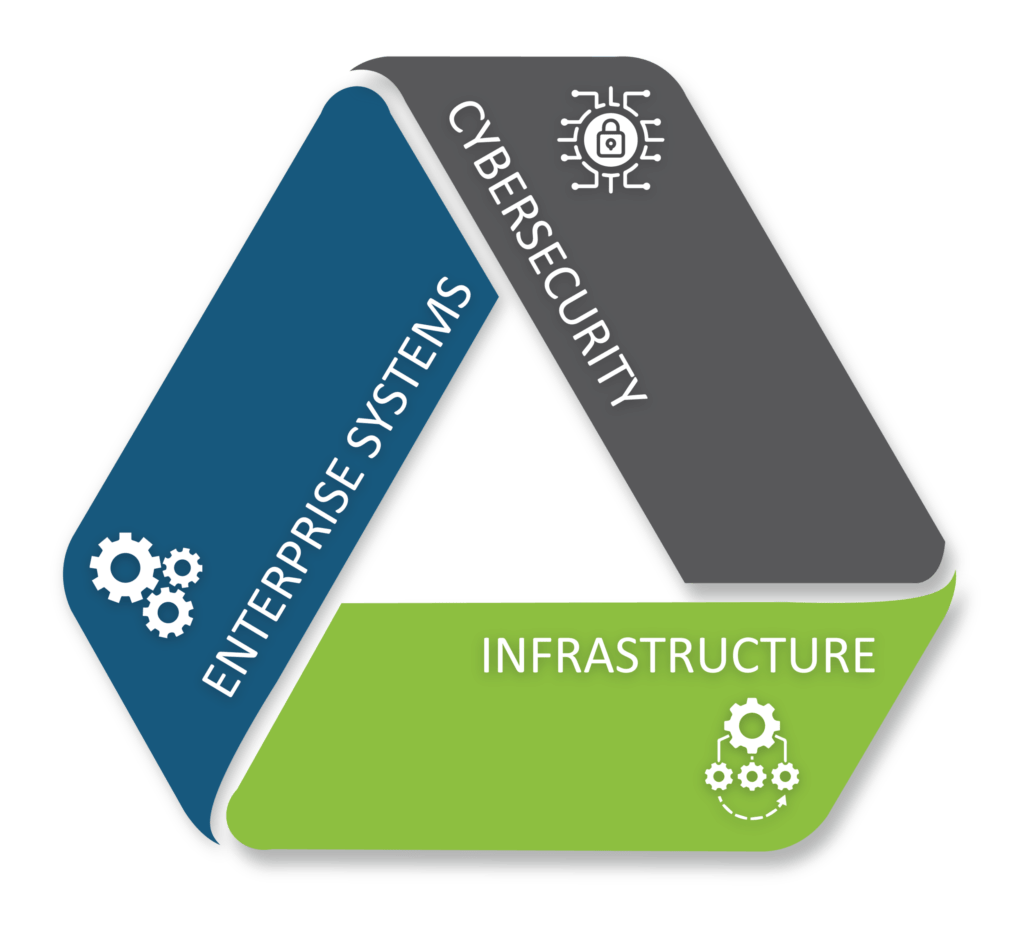

Extensive experience in the private assets investing/finance industry provides a versatile, unbiased, and common-sense approach to solving the needs of various types of investors with varying portfolio needs.

Having analyzed and invested in multiple private assets sub-sectors. Freedomization is well versed in the unique attributes of each and how they can be put together to construct versatile portfolios.

Freedomization has a long track record of educating investors (of various sophistication levels) on key aspects/benefits of private assets investing.

Through thorough market mapping, Freedomization has the ability to home in on the most suitable managers to solve specific investor needs.

Freedomization has conducted all facets of investment and operational due diligence. Freedomization’s goal is to use all methods to make asymmetric (managers telling you only what they want you to know) information as symmetric as possible.

Through numerous pitchbook reviews, data room dives, manager meetings, due diligence sessions, reference calls, etc., Freedomization’s personnel have developed a strong ability to detect key points of differentiation.

Freedomization has constructed, advised on, and assessed various private assets portfolios that are able to effectively complement traditional (public equity and fixed income) holding/exposure.

Freedomization’s private assets/finance industry network is deep and broad. This allows for minimal degrees of separation and the attainment of actionable insights that cut to the core of what is needed/important for private assets investing.

Insights

Sourcing Investment Ideas

I vividly recall sitting in multiple finalist presentations where the

Second Looks/Chances

The frenetic pace of information synthesizing and the sheer number

Reference Calls

From an allocator’s perspective, regardless of how inclusive (for legitimate

The Beauty of Venture Capital – A Love Letter

Dear Venture Capital, It has been a while now since

Co-investments – Friend or Foe?

Even more than the illiquidity (long lock-up periods), relative lack

Re-ups – Do you still love me?

The ultimate goal for most private equity investors is for

Burgeoning – Getting Bigger and Bigger

“What is your target fund size?” – this is one

Uncorrelated Returns

Portfolio construction in private assets investing is a domain saturated

My 2024 Anti List

Keeping with the sometimes-annoying tradition of a plethora of “lists”

The Many Faces of Track Records

The top of a limited partner’s (“LPs”) funnel is a

Can you tell me about your past mistakes?

Throughout the years, I have had countless conversations with fellow

Examining the Psyche behind GP-led Secondaries (Continuation Funds)

As part of the fellowship of analysts, allocators, and investors

An Undying Love Affair with Funds of Funds

I have always had a soft spot for funds of

Breaking a Culture of Echo Chamber Investing

In my almost 20 years of private assets investing, the

Linked Resources

Team

Founder, Head of Research

Anthony K. Hagan

Background

- iCapital: SVP of Research and Education (5/2023 to 10/2023)

- Crewcial Partners: Partner/Director of Private Assets/IC Member/Mgmt. Committee (6/2007 - 5/2023)

- Princeton Theological Seminary: Investment Committee Member (2/2021 - Present) New York University (NYU), MBA