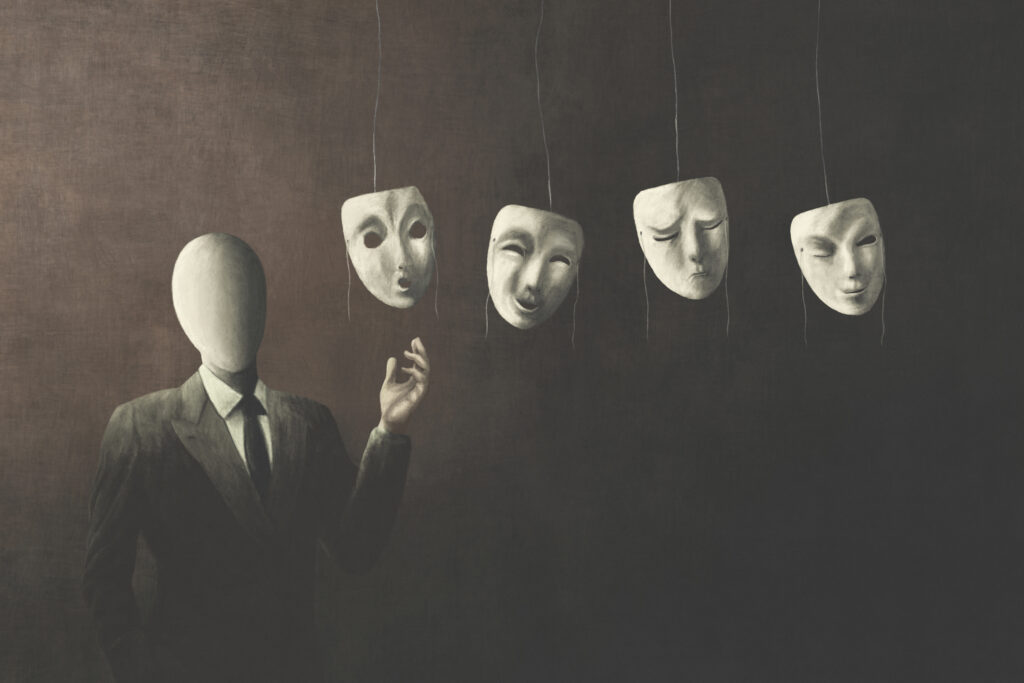

In addition to the determination of capital loss and excess volatility risks, the assessment of “reputational risk” is vital when evaluating investment opportunities. However, reputational risk is among the most difficult to quantify since no standard measurement system is available. In the quest to determine a manager’s reputational risk, past performance, verbal/written transparency, reference calls, organizational philosophy, cohort gossip, ethical signals, etc. are all fair game. Reputation is one of the first things to be considered when due diligence begins, but it can also lay latent and suddenly emerge based on interactions with the manager or discoveries made during the assessment process.

In assessing investment opportunities, reputational risk presents a formidable gray area, as certain prickly personalities could actually be beneficial to certain types of investments. As an example, managers who specialize in distressed opportunities, debt workouts, or activist activities may have a reputation as sharp-elbowed, cold, or litigious, but their reputations should be less tarnished by these traits than venture or buyout managers described in the same manner. This means there is always an implicit or explicit sliding scale at play when a reputational score is added to the overall risk evaluation of an investment manager. Since reputation cannot be measured scientifically, fiduciary responsibility, human decency, and ethical rules of engagement are often the focus of attention when attempting to sketch a manager’s reputational profile. The following are a few areas in which analysts tend to probe when mapping out a manager’s character.

- What club do they belong to and who is in their friend group?: The adage “Show me your friends and I will show you your character” succinctly sums up this point. Knowing which other investment managers invest in or with, hang out with, and hold high regard for the manager being evaluated is helpful. “Brand transfer” occurs when a manager’s cohort can be authenticated – the effect can be particularly powerful when the analyst is well acquainted with and respects some of the group members.

- Which LPs have been loyal to the manager?: Without insinuating that other investors’ due diligence can be used as a substitute for your own, there is still valuable information in understanding the caliber of LPs that have entrusted the manager with capital over time. This information can be used as a launch pad for reference calls, or even, when the size of specific LPs’ investments are considered, to determine where the manager may fall on the institutional or overall risk scale.

- References – how have they generally treated people?: An investment manager interacts with various stakeholders during the execution of its investment strategy, including, employees, LPs, portfolio company management teams, lending institutions, co-investors, service providers, and operating partners. An understanding of the manager’s ethical and fair treatment of these people will provide some indication of the manager’s reputation.

- How have they generally acted in the past?: Closely related to the above point, determining the reputation of a manager can be significantly influenced by getting a sense of any questionable or laudable past actions. This is the proverbial “front page of the newspaper” test. Have any of the manager’s past actions ever made it to the media airwaves? Or, if any of the manager’s unpublicized past actions had become front-page news, what would the effects be? As reputation is strongly influenced by perception, actions from the past that are perceived as unethical, selfish, greedy, gaudy, or tone-deaf could irreparably erode reputation.

- Contextual adjectives: A manager’s reputation is shaped in large part by the knee-jerk description provided by those who know them best. The rumor mill also plays a huge part in weaving the fabric of one’s reputation. The words “patient investors”, “aggressive”, “opinionated”, “highly selective”, “intellectual”, “forthcoming”, “value-oriented”, “humble”, “real”, “deal snipers”, “greedy”, “bullies”, “asset gatherers”, “bush league”, and “elitist” are some shorthand ways managers have been described to me. A calcified opinion of one’s character, regardless of how unfair, is extremely difficult to overcome.

- Traditional background checks: The standard background check provides both confirmation of known facts and the possibility of discovering unknown character traits of a manager. This is an unbiased useful tool for ensuring that all bases have been covered during the due diligence process.

A “reputation” is fundamentally a mosaic of past actions that are used to predict future behavior. The assessment of “reputational risk” is an imperfect endeavor, but analysts will use all available means (tangible or intangible) to ensure thoroughness. Managers need to understand that all their actions and associations are constantly being monitored by the marketplace, and although most accept total infallibility as a myth, managing other people’s money will always be accompanied by an increased level of scrutiny.

Anthony Kwesi Hagan

Founder and Head of Research, FreedomizationTM

August 25th, 2024.